HU version below ↓↓↓

A cikk magyar nyelven Tovább kattintva lentebb olvasható.

---

6 minutes reading time ||| 6 perc olvasási idő

EN version

The year 2022 will most probably remain remembered as the year of ups and downs, especially on the energy markets. Europe saw an unprecedented increase and/or the decrease of prices, volatility, consumption, liquidity, margin requirements, storage levels, pipeline supplies, LNG inflows or even temperatures.

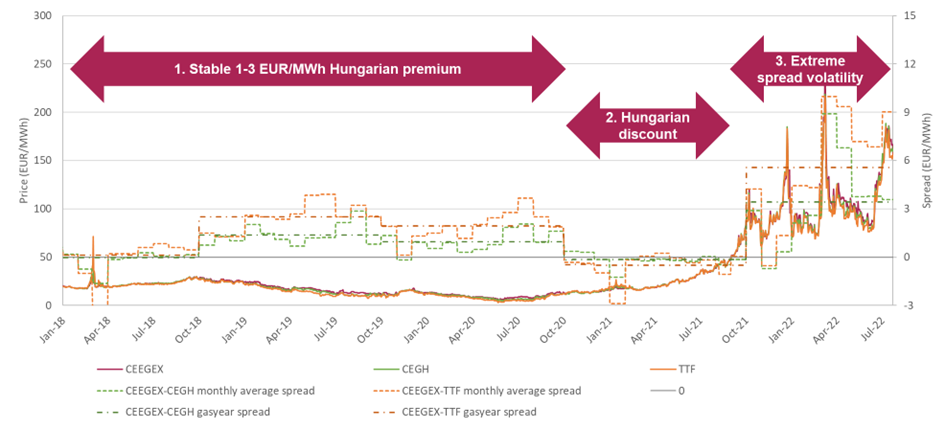

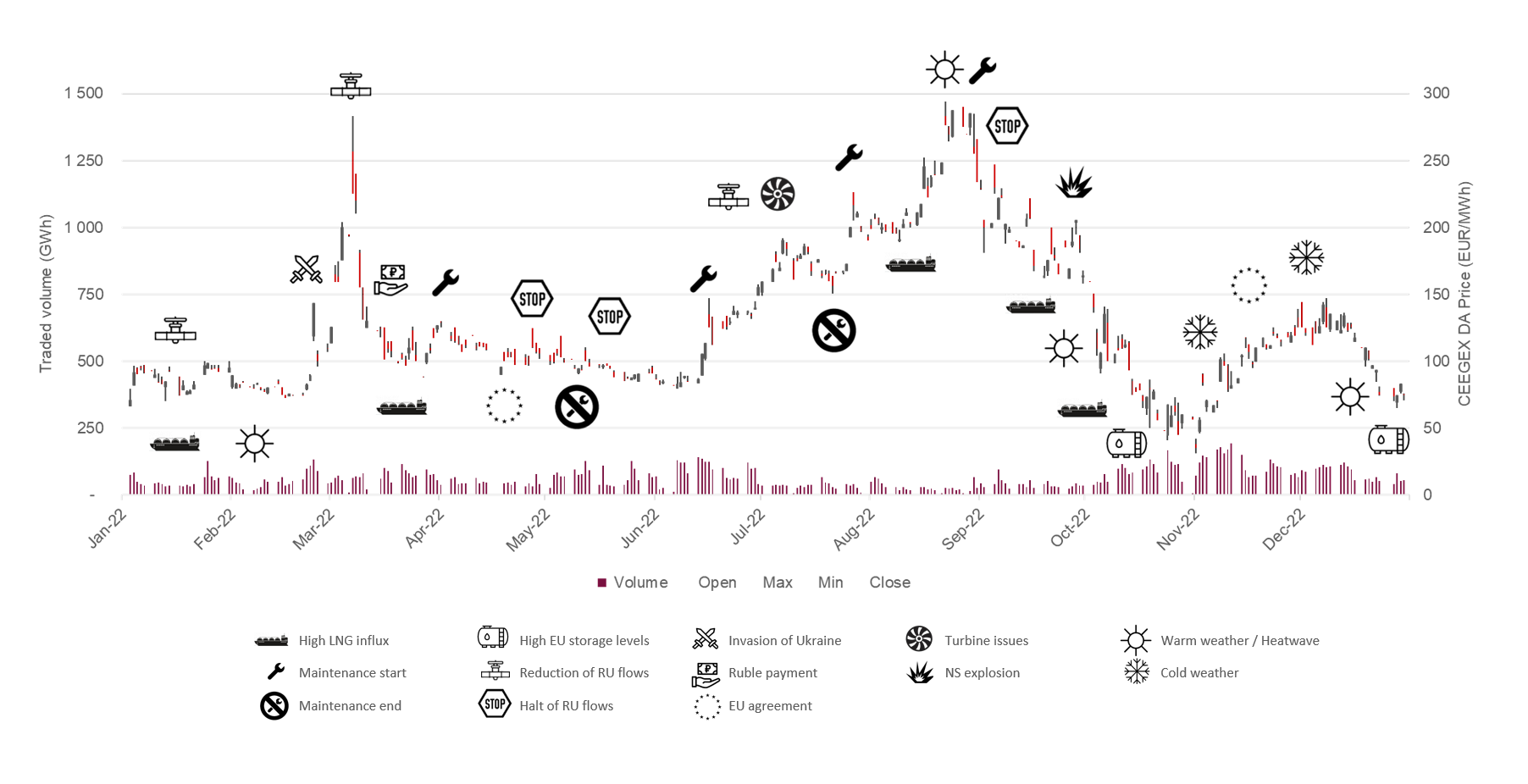

The below chart provides a schematic overview of the past calendar year from the perspective of natural gas markets, while the article provides a more detailed summary of the most important events.

Chart 1: Price movements and main market drivers in 2022

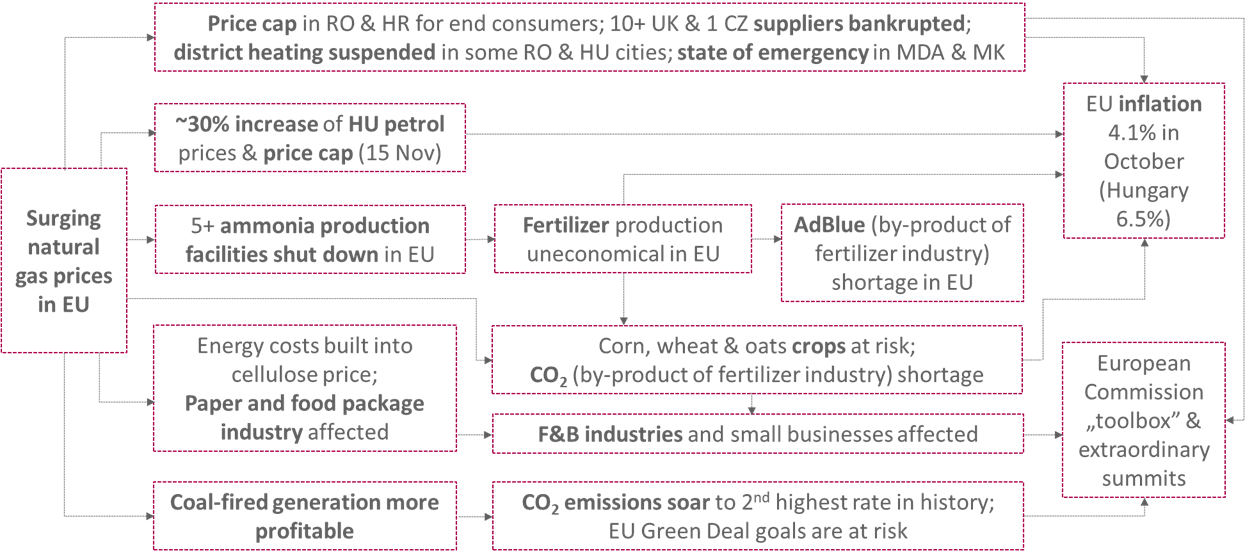

Last January European governments were mostly busy with finding ways to curb the rise of household energy prices. At that time the main driver of bullish prices was supply tightness – Russian imports almost halved at the beginning of the year compared to January 2021 and EU aggregated storages were depleted at a nearly record low 53% level.

Last January European governments were mostly busy with finding ways to curb the rise of household energy prices. At that time the main driver of bullish prices was supply tightness – Russian imports almost halved at the beginning of the year compared to January 2021 and EU aggregated storages were depleted at a nearly record low 53% level.

Russian military drills on the Ukraine border and the suspension of Nord Stream 2 certification had already sparked fears, but on 24 February prices rose by around 40% within a day right after the invasion. Gas markets further surged at the beginning of March and hit an all-time high, rising above the 200 EUR/MWh psychological threshold when it became evident that Russia would not withdraw in spite of the sanctions. The market priced in the risk of a halt in Russian supplies either due to damage of key infrastructure or due to Russia deliberately stopping the flows.

Nonetheless, prices corrected down in March on ample LNG and as Russian flows (mostly via the Nord Stream 1 pipeline) remained stable. Still, prices could not return to the pre-war level. Further sanctions were announced, like the exclusion of Russian banks from the SWIFT payment system, major international energy companies walked away from Russian energy projects. The Commission unveiled its REPowerEU plan to reduce the block’s reliance of Russian gas by two thirds by the end of 2022, while the Russian president announced ruble payment for ‘unfriendly’ countries.

In the upcoming two months Russia sanctioned the owner of the Polish section of the Yamal pipeline and suspended supplies to five European countries, which refrained from paying in the Russian currency. As all of them were able to replace Russian gas quickly, prices and volatility could have remained relatively moderated. Even though Norwegian maintenances commenced and both Germany and Austria triggered the first stage of gas emergency, the record high LNG flooding to Europe (primarily from the US), muted LNG demand from Asia (due to COVID lockdowns in China) and accelerating new infrastructure developments and diversification efforts of EU member countries kept a lid on prices.

And then the summer maintenance period kicked in reducing Russian flows and bringing back the bullish sentiment. In June flows on the Nord Stream 1 pipeline dropped to 40% of capacity due to turbine issues, just a month before the planned annual maintenance when flows stopped for ten days. Soon supplies were suspended also on the TurkStream during a seven-day planned maintenance, moreover one of the largest US LNG terminals (Freeport) went offline for months after a fire accident.

In July Nord Stream 1 supplies were restricted to 20% of capacity because of turbine documentation problems, notwithstanding the repairing country Canada had already exempted the turbines from sanctions. By the end of August a three-day outage was announced on the same pipeline, which later proved to be permanent. The Nord Stream 1 halt was the last straw on top of Norwegian outages, weeks of heatwaves and weak wind generation. The drought not only resulted an increase in power demand, but low river levels reduced coal shipments to Germany and limited nuclear capacity in France. By the way, 2022 was Europe’s second-warmest year so far. The heightened injection demand deriving from the 85% storage level obligation added further stimulus. This was the point when LNG supplies and the 15% gas saving obligation could not mitigate the bullish factors anymore and gas prices skyrocketed to never seen levels above 300 EUR/MWh.

However, September broke this trend as aggregated EU storage levels surpassed 80%, new infrastructure came online (Baltic Pipeline, IGB, Eemshaven FSRU) and demand destruction became more and more visible. The Commission’s announcement of emergency energy market interventions, like revenue caps, joint gas buying, a new LNG index or the idea of an EU wide price cap also resulted selling activity on gas markets. Market participants became such confident about sufficient gas reserves for the winter that the explosion on the Nord Stream 1 and 2 pipelines could not spur back prices to their August levels.

With the start of the gas year markets gradually cooled down as above average temperatures, improved renewable output and curbed demand delayed the start of withdrawals by one month. At the same time remaining Russian supplies were not suspended – despite previous threats in case Europe approved a cap on gas prices. Moreover, LNG deliveries from the US, Algeria, Qatar and even Russia ramped up resulting in a short glut around the ports of Spain. Northwest European LNG terminals were running on almost full send-out capacities, while storage levels approached 100%. New FSRU terminals (Wilhelmshaven) and interconnectors (e.g. PLSK) became operational, which in turn triggered changes in the traditional gas routes within Europe.

But together with prices both industrial and household consumption also lowered as a consequence of formerly high energy prices and energy efficiency measures. Between August and November the decrease of the average gas consumption of the European Union exceeded the 15% target, in some countries reaching 50% versus the five-year average. Although the cold spell in the first half of December resulted in a rise in heating demand and higher pace of storage withdrawals, but later storages in several European countries turned to injection mode thanks to the mild weather during the holiday season. It is emblematic that the EU’s gas crisis package was accepted on 19 December at pre-war price levels and storage levels above 80%.

Trading activity on the European exchanges was also severely affected by record high prices and extreme volatility. Liquidity from OTC markets shifted to the exchanges despite higher margin requirements so that market participants avoided the rising counterparty risk. Even with the increased liquidity on certain European hubs and a shift to spot trading, European traded volumes on overall decreased roughly by 20%, mostly driven by a throw-back on TTF futures markets.

To wrap up 2022, from the very beginning of the year the tension was up and markets were buoyed by fears of dropping Russian volumes, prices reacted fiercely on any news relating to the supply and demand. But as Europe approached the new heating season with higher and higher storage levels combined with unseasonably mild temperatures, record high LNG influx and lowering demand the market sentiment also calmed down.

---